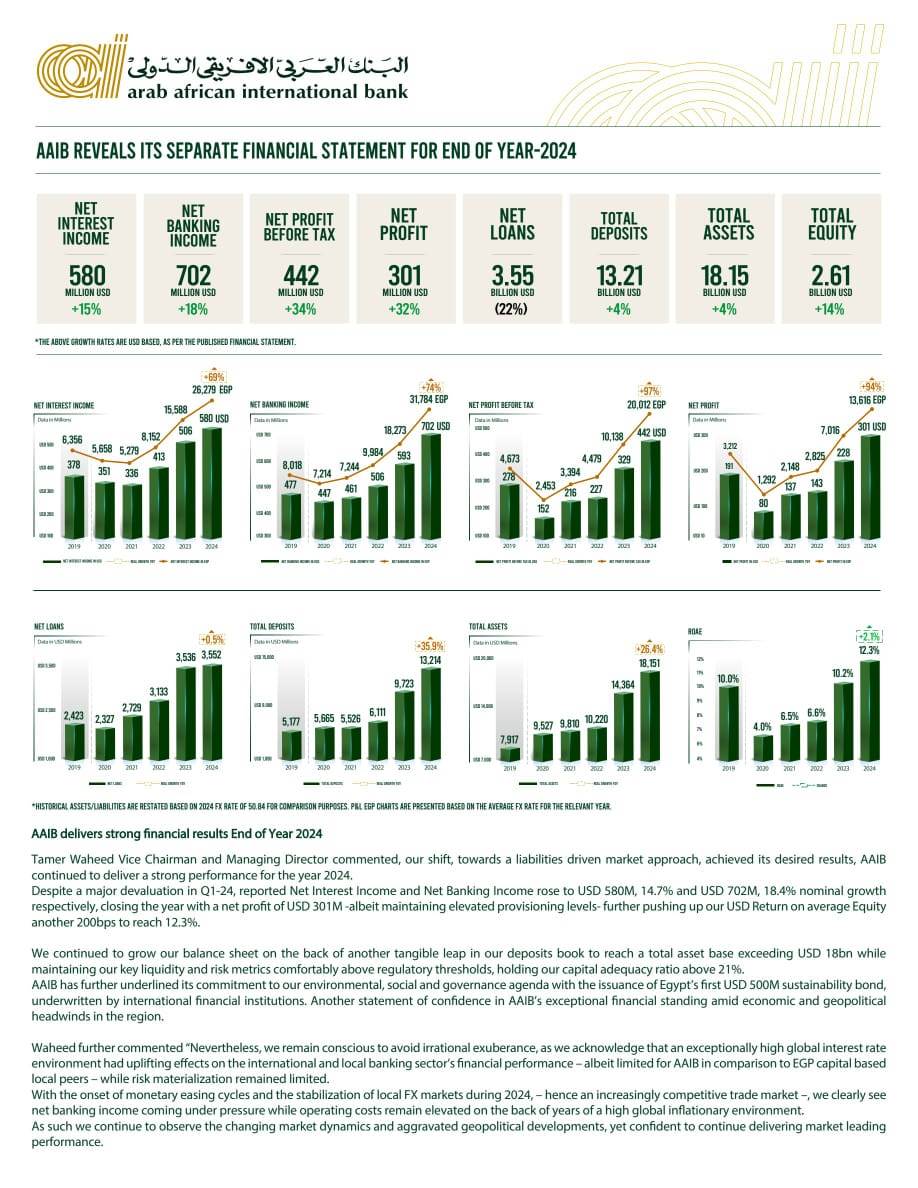

Tamer Waheed Vice Chairman and Managing Director commented, our shift, towards a liabilities driven market approach, achieved its desired results, AAIB continued to deliver a strong performance for the year 2024.

Despite a major devaluation in Q1-24, reported Net Interest Income and Net Banking Income rose to USD 580M, 14.7% and USD 702M, 18.4% nominal growth respectively, closing the year with a net profit of USD 301M -albeit maintaining elevated provisioning levels- further pushing up our USD Return on average Equity another 200bps to reach 12.3%.

We continued to grow our balance sheet on the back of another tangible leap in our deposits book to reach a total asset base exceeding USD 18bn while maintaining our key liquidity and risk metrics comfortably above regulatory thresholds, holding our capital adequacy ratio above 21%.

AAIB has further underlined its commitment to our environmental, social and governance agenda with the issuance of Egypt’s first USD 500M sustainability bond, underwritten by international financial institutions. Another statement of confidence in AAIB’s exceptional financial standing amid economic and geopolitical headwinds in the region. Waheed further commented “Nevertheless, we remain conscious to avoid irrational exuberance, as we acknowledge that an exceptionally high global interest rate environment had uplifting effects on the international and local banking sector’s financial performance – albeit limited for AAIB in comparison to EGP capital based local peers – while risk materialization remained limited.

With the onset of monetary easing cycles and the stabilization of local FX markets during 2024, – hence an increasingly competitive trade market –, we clearly see net banking income coming under pressure while operating costs remain elevated on the back of years of a high global inflationary environment.

As such we continue to observe the changing market dynamics and aggravated geopolitical developments, yet confident to continue delivering market leading performance.

إخلاء مسؤولية إن موقع بالبلدي يعمل بطريقة آلية دون تدخل بشري،ولذلك فإن جميع المقالات والاخبار والتعليقات المنشوره في الموقع مسؤولية أصحابها وإداره الموقع لا تتحمل أي مسؤولية أدبية او قانونية عن محتوى الموقع.

"جميع الحقوق محفوظة لأصحابها"

المصدر :" بنكي "

0 تعليق